Introduction

Investing can be scary and confusing at times. But the basic principles of successful investing are timeless and quotes from experts help illuminate these. This note revisits a series on insightful quotes on investing I first started a decade ago.

The aim of investing

“How many millionaires do you know who have become wealthy by investing in savings accounts?” Robert G Allen, investment author

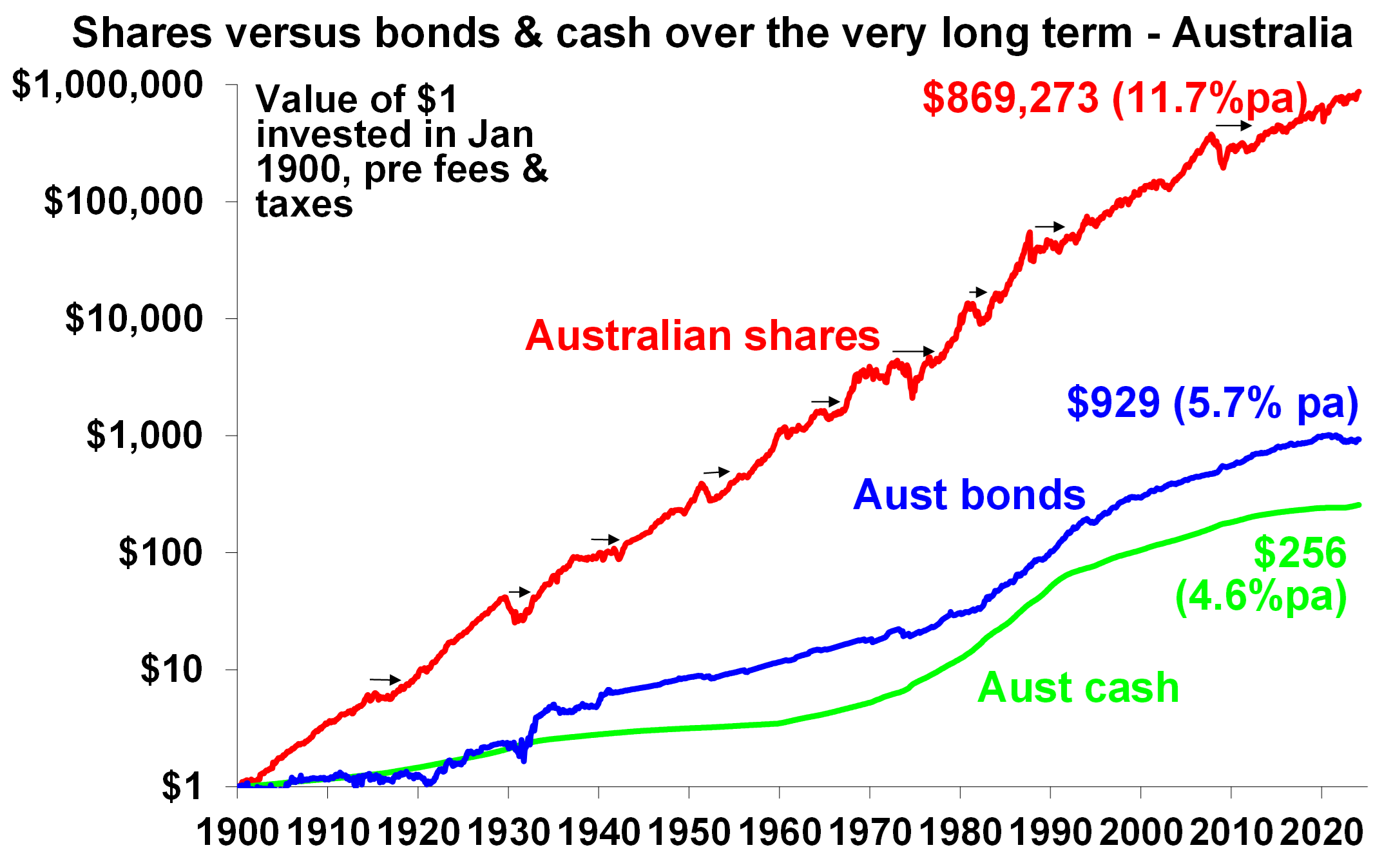

Cash and bank deposits are low risk and fine for near term spending requirements and emergency funds, but they won’t build wealth over long periods of time. The chart below shows the value of $1 invested in various assets since 1900. Despite periodic setbacks (see the arrows) shares and other growth assets like property (not shown) provide much higher returns over the long term than cash and bank deposits.

Source: ASX, RBA, AMP

“The aim is to make money, not to be right.” Ned Davis, investment analyst

There is a big difference between the two. But many let their blind faith in a strongly held view (e.g. “there is too much debt”, “aging populations will destroy share returns”, “global oil production will soon peak”, “the IT revolution means this time it’s different”) drive their decisions. They could be right at some point but end up losing a lot of money in the interim.

The investment process

“Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.” Warren Buffet, investor, chair & CEO of Berkshire Hathaway

Unless you really want to put a lot of time into trading, it’s advisable to only invest in assets you would be comfortable holding for the long term. This is less risky than constantly tinkering in response to predictions of short-term changes in value and all the noise around investment markets.

“Investing should be like watching paint dry or watching grass grow. If you want excitement…go to Las Vegas.” Paul Samuelson, economist

Investing is not the same as gambling and requires a much longer time frame to payoff.

“Successful investing professionals are disciplined and consistent and they think a great deal about what they do and how they do it.” Benjamin Graham, investment author, “father of value investing”

Having a disciplined investment process and consistently applying it is critical for investors if they wish to actively manage their investments successfully in the short term.

“Don’t look for the needle in the haystack, just buy the haystack!” John C Bogle, founder of Vanguard

The key insight here is that trying to beat the market by stock picking can be hard and so if you want to grow wealth over time the key is to get a broad exposure to the market and letting compound interest do its job.

The investment market

“Remember that the stock market is a manic depressive.” Warren Buffett

Rules of logic often don’t apply in investment markets. The well-known advocate of value investing, Benjamin Graham, coined the term “Mr Market” (in 1949) as a metaphor to explain the share market. Sometimes Mr Market sets sensible share prices based on economic and business developments. At other times he is emotionally unstable, swinging from euphoria to pessimism. But not only is Mr Market highly unstable, he is also highly seductive – sucking investors in during the good times with dreams of riches and spitting them out during the bad times when all hope seems lost. Investors need to recognise this.

“Markets can remain irrational longer than you can remain solvent.” John Maynard Keynes, economist

A key is to respect the market and recognise that it can be fickle rather than try and take big bets that can send you bust if you get the timing wrong. For example, by heavily selling shares short if you think a crash is about to happen or gearing in too heavily via margin debt when the market is strong. Such approaches can often undo investors and send them bust as they are too dependent on accurately timing the market.

Investment cycles and contrarian investing

“Bull markets are born on pessimism, grow on scepticism, mature on optimism and die of euphoria.” John Templeton, investor

This is one of the best characterisations of how the investment cycle unfolds. It follows that the point of maximum opportunity in terms of prospective return is around the time most investors are pessimistic and bearish and the point of maximum risk is when most investors are euphoric and bullish, but unfortunately many don’t realise this because it involves going against the crowd.

“The four most dangerous words in investing are: ‘this time it’s different’.” John Templeton

History tells us that that there are good times and bad and assuming that either will persist indefinitely is a big mistake. Whenever you hear talk of “new paradigms”, “new eras”, “new normals” or “new whatevers” it’s usually getting time for the cycle to go in the other direction.

“History doesn’t repeat but it rhymes.” Often attributed to Mark Twain (although it’s not sure he actually said it), author

No two cycles are the same, but they do have common elements which make them rhyme. In upswings investment markets are pushed to the point where the relevant asset has become overvalued, over loved (in that everyone is on board) and over bought and vice versa in downturns.

Recognising these common elements is necessary if you are to get a handle on cyclical swings in investment markets.

“If it’s obvious, it’s obviously wrong.” Joe Granville, investment author

This doesn’t apply to everything (e.g. if it is obviously sunny outside according to the usual definition, then it is!), but investing can be perverse. When everyone is saying “it’s obvious that the recession will continue” or “it’s impossible to see a recession as things are obviously good” then maybe the crowd is already on board and the cycle will soon turn.

“I will tell you how to become rich…Be fearful when others are greedy. Be greedy when others are fearful.” Warren Buffett

This is another great quote on contrarian investing that follows on from those above.

“Sell in May and go away, buy again on St Leger’s Day.” Anon

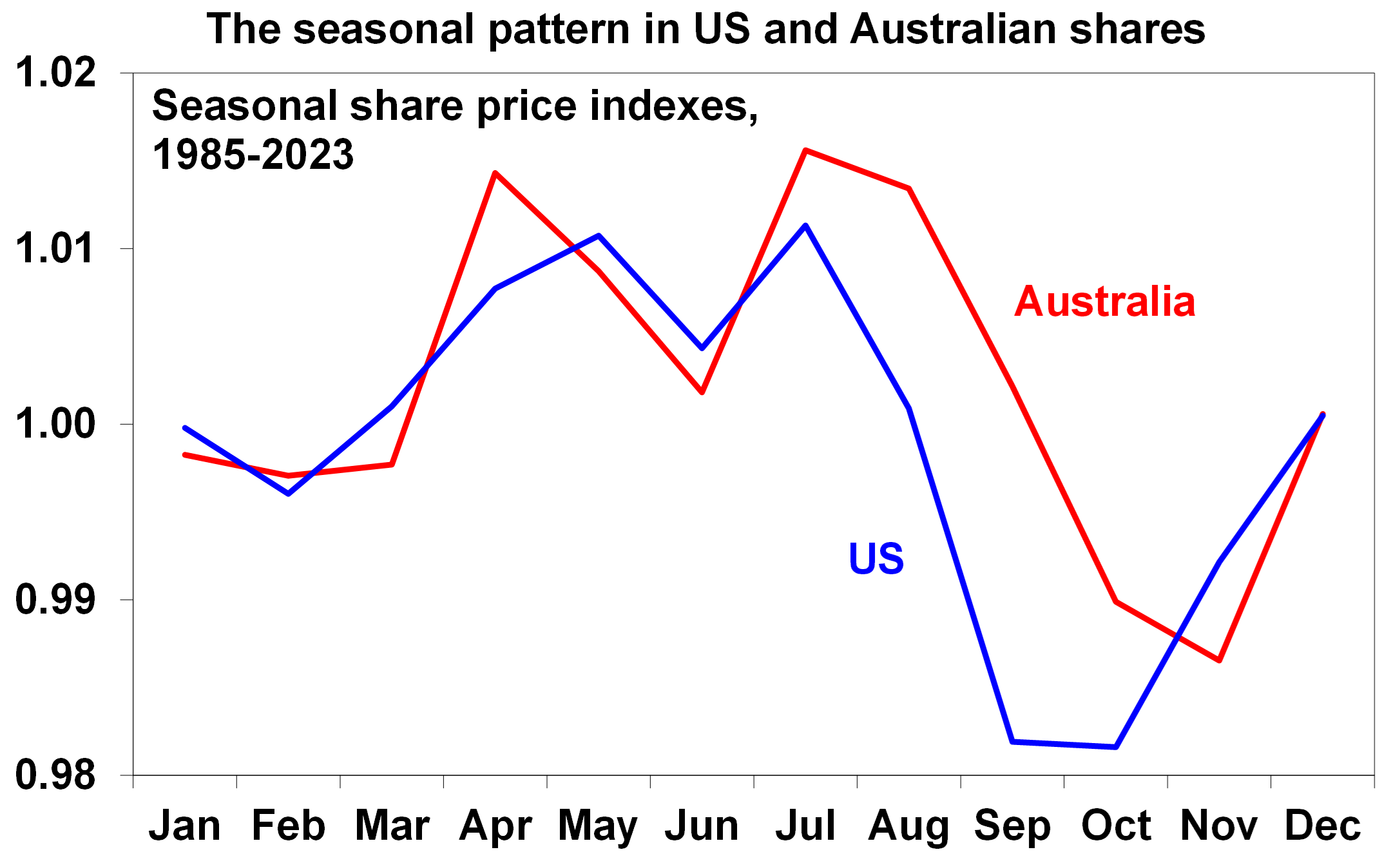

Shares have long been observed to have a seasonal pattern that sees strength from November through to May and then relative weakness through to around October. This can be seen in seasonal indexes for US and Australian shares in the next chart. (St Leger’s Day in terms of the UK horse race on the second Saturday in September may be a bit early, but not to worry!)

Source: Bloomberg, AMPl

The reasons vary and relate to tax loss selling associated with a September tax year end for US mutual funds, a wind down in new equity raisings around December/January, New Year cheer and the investment of bonuses, but may have its origins in crop cycles. The point is that buying in May, might not be the best time, nor selling in September or October.

Investor pessimism

“To be an investor you must be a believer in a better tomorrow.” Benjamin Graham

This is a pre-requisite. If you don’t believe the bank will look after your term deposits, that most borrowers will pay back their debts, that most companies will see rising profits over time, that properties will earn rents etc then there is no point investing. This is flippant but true – to be a successful investor you need a favourable view of the future.

“More money has been lost trying to anticipate and protect from corrections than actually in them.” Peter Lynch, investor, fund manager

Preserving capital is important, but this can be taken too far and often is in the aftermath of bad times with the result that investors end up so focused on trying to avoid capital losses in share markets that they miss the returns they offer.

“I have observed that not the man who hopes when others despair, but the man who despairs when others hope, is admired by a large class of persons as a sage.” J.S. Mill, economist

It invariably seems that higher regard is had for pessimists predicting disaster than for optimists seeing better times. As the US economist JK Galbraith once observed “we all agree that pessimism is a mark of a superior intellect.” And we all know that bad news sells. There may be a neurological reason for this as the human brain evolved in the Pleistocene era when the key was to dodge woolly mammoths and sabre tooth tigers, so it has been hard wired to be always on guard and so naturally attracted to doom sayers. But for investors, giving too much attention to pessimists doesn’t pay over the long term.

Risk

“There is nothing riskier than the widespread perception that there is no risk.” Howard Marks (I think), investor, co-founder of Oaktree Capital

Many like to measure risk by looking at measures of volatility, but the riskiest time in markets is invariably when the common view is that there is no risk for it’s often around this point that everyone who wants to invest has already done so leaving the market vulnerable to bad news.

Debt

“It’s not what you own that will send you bust but what you owe.” Anon

Always make sure that you don’t take on so much debt that it may force you to sell all your investments and potentially send you bust, just at the time you should be buying.

The right mindset for an investor

“The investor’s chief problem and even his worst enemy is likely to be himself.” Benjamin Graham

This may sound perverse as surely it is events which drive investment markets down and destroy value. But the trouble is that events and bear markets are normal. Rather what causes the greatest damage is our reaction to events – selling after markets have already plunged and only buying back in after euphoria has returned. Smart investors have an awareness of their psychological weaknesses and their tolerance for risk and seem to manage them.

“You get recessions, you have stock market declines. If you don’t understand that’s going to happen then you’re not ready, you won’t do well in the markets.” Peter Lynch

If you can’t handle volatility associated with investment markets, then either they are not for you or you should just take a long term approach and leave it to someone else to manage and advise on the investment of your funds.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.